ACH Origination

Overview

Evolve collects Nacha formatted batch entries from the Customer and originates the ACH on behalf of the Customer (the ACH originator). Evolve requires submitted files to be unbalanced, where Evolve automatically offsets the transfer to the Customer’s account at Evolve.

The ACH file is passed through the ACH Network to the RDFI, where the debits and credits are applied to the account at the other bank. Settlement typically takes place at the end of the day of the scheduled ACH transaction.

Processing Times

Evolve can process standard ACH files, as well as same-day ACH files. The processing time of an ACH file is determined by the day the file is delivered to Evolve compared to the effective date of the file. For example, the effective date of a Next Day ACH is the day after the file is delivered to Evolve.

Whereas the effective date of a Same Day ACH is the same date that the file is delivered to Evolve. ACH Transactions can be scheduled for Same Day, Next Day, Late Night, Sunday, and Future Dated processing. For files to be processed on time, the ACH file must be delivered to Evolve prior to the cutoff times listed below:

| ACH Priority | Cutoff | Funds Moved (Credit) | Completion (Credit) | Funds Moved (Debit) | Completion (Debit) |

|---|---|---|---|---|---|

| Normal | 20:00CT | Next Day | Next Day | Next Day | Two Days |

| Same-Day | 10:00CT | Same-Day | Next Day | Next Day | Next Day |

Same Day

Same Day files received by 10:00 am Central time (Monday-Friday) will be processed and made available that same day. The effective date should be listed as the same day the file is delivered to Evolve. A same-day entry must be for an amount of $1,000,000 or less*.

Important Note:Evolve will address limit adjustments on a case-by-case basis. All Originators and Third-Party Senders should discuss with Evolve whether and when originating debit and/or credit entries up to $1,000,000 is appropriate for their business.

Next Day

Evolve must receive the Nacha formatted file by 8:00pm Central time (Monday-Friday). The effective date should be listed as the day following the date the file is delivered to Evolve.

Future Dated

Future-dated files received by 8:00 pm Central time (Monday-Friday) will be processed and made available on the effective date listed in the ACH file. Credits may be scheduled 2 business days in advance, and debits may be scheduled 1 business day in advance.

File Processing Schedules

2026 File Processing Schedule

For every Federal Holiday in 2026, except Christmas Day, Evolve will process on the following schedule:

- Evolve will process Same-Day ACH files received by the 10:00 AM CST same-day processing cut-off time on the Federal Holiday.(If agreed upon same-day processing cut-off time differs, follow standard process.)*

- Evolve will forward Next-Day ACH files received on the Federal Holiday by the 8:00 PM CST next-day processing cut-off time to the next day to process (except Saturday and Christmas Day).

- Evolve does not process on Saturdays nor on Christmas Day.

Special pricing will apply for processing on holidays.

Evolve will process ACH files received by the correct cut-off times on the Federal Holidays listed below:

| Date | Day of the Week | Holiday |

|---|---|---|

| January 1st, 2026 | Thursday | New Year's Day |

| January 19th, 2026 | Monday | Martin Luther King, Jr. Day |

| February 16th, 2026 | Monday | Presidents' Day |

| May 25th, 2026 | Monday | Memorial Day |

| June 19th, 2026 | Friday | Juneteenth National Independence Day |

| July 4th, 2026* | Saturday | Independence Day |

| September 7th, 2026 | Monday | Labor Day |

| October 12th, 2026 | Monday | Indigenous Peoples' Day/Columbus Day |

| November 11th, 2026 | Wednesday | Veterans Day |

| November 26th, 2026 | Thursday | Thanksgiving Day |

| December 25th, 2026 | Friday | Christmas Day |

*= For holidays falling on Saturday (ex. 7/4/2026), Federal Reserve Banks and Branches will be open the preceding Friday.

Evolve will not process any files received on the Federal Holiday listed below:

| Date | Day of the Week | Holiday |

|---|---|---|

| December 25th, 2026 | Friday | Christmas Day |

If the Holiday falls on a Sunday, Evolve will process both on the actual date of the holiday and on the Federal Reserve’s observed holiday on the following Monday, except for Christmas Day.

On-Us ACH

On-Us ACH entries are scenarios where the originated ACH transaction identifies Evolve held accounts for both the account being debited and the account being credited. These types of ACH transactions can occur between accounts of the same or varying programs, as long as the funds for each account are held by Evolve. The receiving account will be credited on the Effective Date of the ACH, given that the ACH entry was received prior to the cutoff times defined in the Processing Times section.

Because both the beneficiary account and originating account are held at Evolve, a direct exchange occurs between the two accounts. In this scenario, the on-us ACH transaction is not delivered to the Federal Reserve. It is also important to note that Evolve will not generate a Production Trace Number for on-us ACH transactions in the ACH Trace file.

Nacha File Format

All ACH files must be delivered to Evolve in Nacha file format via SFTP. Nacha (National Automated Clearing House Association) manages the development, administration and governance of the ACH Network, which is the backbone for the electronic movement of funds and data within the United States.

Quick Stats:

- The maximum number of lines in a Nacha file including Entry and Addenda line count is 99,999.

- The maximum number of batches in a Nacha file is 9,999.

- For more information about Nacha, visit their website here.

- For assistance with ACH Line Count, refer to the Nacha rules.

ACH Standard Entry Class Codes

Evolve accepts the following ACH Standard Entry Class (SEC) Codes, or types, in Nacha files:

| SEC Code | Description |

|---|---|

| ARC* | Accounts Receivable Entry |

| BOC* | Back Office Conversion |

| CIE | Customer Initiated Entry |

| CCD | Cash Concentration and Disbursement |

| CTX | Corporate Trade Exchange |

| POP | Point-of-Purchase Entry |

| PPD | Prearranged Payment and Deposit |

| RCK | Re-presented Check Entry |

| TEL | Telephone-Initiated Entry |

| WEB | Internet-Initiated Entry |

*Origination of these SEC codes require additional Evolve management approval.

Receiving Returns

Originated ACHs have the opportunity to be refused by the RDFI.

If an ACH originated by the Customer is refused, Evolve will receive a Return from the other bank. Evolve passes this data to the Customer via an Incoming ACH Return file. The Customer will use the data from this file to update the Subledger to reverse the previously originated debits and credits of the end user.

Notifications of Change (NOC)

A Notification of Change (NOC) is a non-dollar entry transmitted by an RDFI to notify the ACH Originator that information in the originated ACH is erroneous and/or is outdated and must be changed.

In the instance of a received NOC, Evolve will notify the ACH Originator of the NOC entry within 1 business day of receipt. The ACH Rules require the ACH Originator to make the requested changes within 6 business days of receipt of the NOC or prior to the next ACH entry, whichever is later.

Change Codes

Code | Reason | Description |

|---|---|---|

C01 | Incorrect bank account number | Bank account number incorrect or formatted incorrectly |

C02 | Incorrect transit/routing number | Once valid transit/routing number must be changed |

C03 | Incorrect transit/routing number | Once valid transit/routing number must be changed and |

C05 | Incorrect transaction code | Entry posted to demand account should contain savings |

C06 | Incorrect bank account number and | Bank account number must be changed, and payment code |

C07 | Incorrect transit/routing number, | Incorrect transit/routing number, |

C09 | Incorrect individual ID number | Individual’s ID number is incorrect |

C13 | Addenda format error | Addenda is formatted incorrectly |

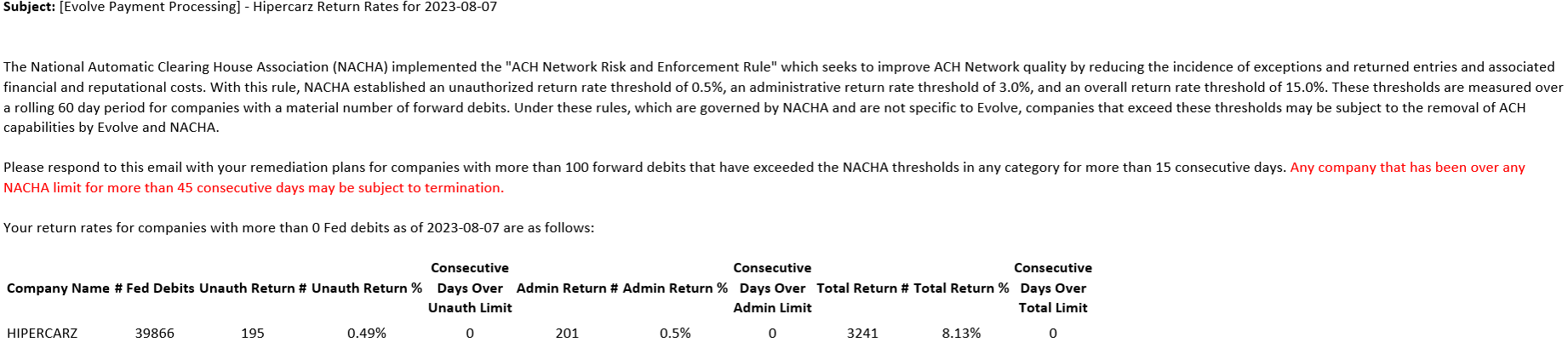

ACH Debit Return Rate Monitoring

When originating ACH debits, customers are responsible for monitoring their compliance with Nacha’s “ACH Network Risk and Enforcement Rule”, which established an unauthorized return rate threshold of 0.5%, an administrative return rate threshold of 3.0%, and an overall return rate threshold of 15.0%.

-

Unauthorized Return Rate: the rate at which an Originator’s or Third-Party Sender’s debit Entries are returned on the basis that they were unauthorized (Return Reason Codes R05, R07, R10, R11, R29, or R51) (Nacha Guidelines, Section 8.116 “Unauthorized Entry Return Rate”)

-

Administrative Return Rate: the rate at which an Originator’s or Third-Party Sender’s debit Entries are returned for administrative reasons (Return Reason Codes R02, R03, or R04) (Nacha Guidelines, Section 8.5 “Administrative Return Rate”)

-

Overall Return Rate: the rate at which an Originator’s or Third-Party Sender’s debit Entries, excluding RCK Entries, are returned, regardless of reason, as calculated in accordance with Subsection 2.17.2.4(d) (ODFI Return Rate Reporting Regarding an Originator’s or Third-Party Sender’s Administrative Return Rate or Overall Return Rate) (Nacha Guidelines, Section 8.71 “Overall Return Rate”)

Customers’ ACH programs are required to stay below these threshold to remain compliant with Nacha’s rules. These thresholds are measured over a rolling 60-day period for ACH companies with a material number

of originated debits.

In addition to calculating all three return rates for every ACH company on a daily basis, Evolve also tracks the number of days that an ACH company has been over or under each of the thresholds for each return rate category.

Evolve ACH Origination clients can work with their Account Management or Implementation contacts to opt into an ACH Return Rates email. This email is be sent on a weekly basis and contains important information regarding their ACH return rates including number of ACH debits, count and percentages of returns, days over limit and more. Below is an example of this email.

In the event that an ACH program exceeds one or multiple thresholds, Evolve will request a remediation plan that addresses the root cause of the excessive returns rates, updated processes and procedures, and timeline for when the return rates will be in good standing. Evolve will continue to monitor the return rates as they relate to the proposed remediation plan.

Please note: If the Customer is unable to comply with Nacha’s rules, Evolve may choose to suspend or terminate the Customer’s ACH program at any time.

ACH Audit and Risk Assessment

As an Evolve Customer, you are responsible for auditing and monitoring your policies and procedures for your solutions. Evolve requires all ACH Originators to undergo an annual ACH audit. Additionally, if the company processes WEB transactions, an annual security audit must also be completed.

Your Evolve Account Manager will work with you to coordinate and plan. For a list of recommended auditing firms or other questions, please reach out to your account manager or email [email protected].

Additionally, the Evolve ACH Agreements state Customers are responsible for implementing a Risk Management System and performing annual Risk Assessments. At least once per year, each originator should provide Evolve a risk assessment performed by a qualified third party in accordance with Nacha Rules.

Please see the Evolve ACH Agreements for details around Risk Assessment requirements.

Updated 2 months ago